Month 2, Day 42 - 36-month forex trading challenge - beware of trading bias.

It's day 42 of the 36-month forex trading challenge and it was another early start this morning. It's never easy getting up early while on holiday, but it's part of my approach to the markets and one that I have to stick to no matter where I am or what I'm doing.

To be honest, I quite like the early starts. The time of day when no one else is awake is a special period where you have your immediate surroundings to yourself. I always find it a great time to think and make decisions, and it's the time (once the coffee has kicked in) that I'm probably at my most productive.

The Trump / China back and forth is in the news this morning, and an article linked out to from Forex Factory highlights the madness of the market moves, as a result of the opinions of one man. The currency markets have been a place where words matter ever since I started trading them, but these words generally came from the Federal Reserve or other central banks. It's a whole new ball game when the US President can move the market on a whim any time he chooses. It's this surprise news that's the dangerous kind and is one major reason why you should always trade with a stop loss in place.

Although I was trumped by Trump yesterday, with tight stops in place my losses were minimised, and today is a whole new dawn with my NZDUSD (T32S) looking to be turning around.

Nothing is guaranteed, but if this trade tracks down to the limit orders I've placed just above the 10-year low this one trade alone could see me back on track with this month's target. It's a reminder that it's not how often you win, but how much you win when you win, compared with how much you lose when you lose.

Reflecting on yesterday, I realised I made a mistake. I was stopped out of my USDCAD (T2L) long and while licking my wounds I failed to notice the signal that presented itself in the opposite direction.

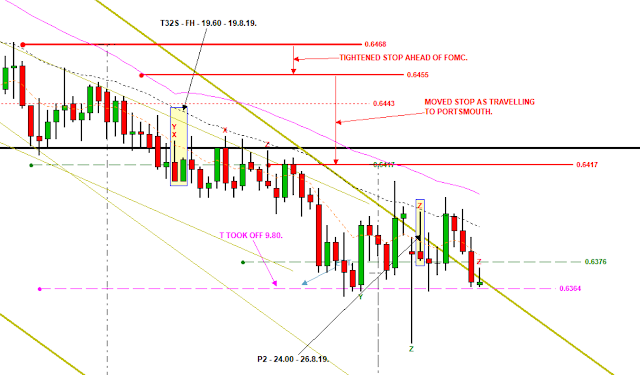

The (grey) highlighted candle (above) shows a TREND signal sell on the very candle that stopped me out. Price had failed to make a higher high, the 50 SMA was flat and the EMAs in line. This was a valid entry signal that would have given me a clear profit (and counting) overnight.

Beware of trading bias – I was so attached to my long position that I failed to see an entry in the opposite direction. This is an important reminder to follow the signals and to take them when they show up (subject to correlation risk).

I'm still in my CHFJPY (T31S) and NZDCAD (T28S) shorts, both of which have made money already and are fully protected (stop loss at entry). As both of these trades have proved their worth, I'm looking to add to them if the signals show up.

As I'm technically on holiday, this will prove difficult today. I'm likely to miss the 10am and 2pm candle closes. This can't be helped and sometimes I know I'll miss signals because I can't be in front of my screen. This is part of the life of a forex trader and specifically the time frame I choose to trade.

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

To be honest, I quite like the early starts. The time of day when no one else is awake is a special period where you have your immediate surroundings to yourself. I always find it a great time to think and make decisions, and it's the time (once the coffee has kicked in) that I'm probably at my most productive.

The Trump / China back and forth is in the news this morning, and an article linked out to from Forex Factory highlights the madness of the market moves, as a result of the opinions of one man. The currency markets have been a place where words matter ever since I started trading them, but these words generally came from the Federal Reserve or other central banks. It's a whole new ball game when the US President can move the market on a whim any time he chooses. It's this surprise news that's the dangerous kind and is one major reason why you should always trade with a stop loss in place.

Although I was trumped by Trump yesterday, with tight stops in place my losses were minimised, and today is a whole new dawn with my NZDUSD (T32S) looking to be turning around.

Nothing is guaranteed, but if this trade tracks down to the limit orders I've placed just above the 10-year low this one trade alone could see me back on track with this month's target. It's a reminder that it's not how often you win, but how much you win when you win, compared with how much you lose when you lose.

Reflecting on yesterday, I realised I made a mistake. I was stopped out of my USDCAD (T2L) long and while licking my wounds I failed to notice the signal that presented itself in the opposite direction.

The (grey) highlighted candle (above) shows a TREND signal sell on the very candle that stopped me out. Price had failed to make a higher high, the 50 SMA was flat and the EMAs in line. This was a valid entry signal that would have given me a clear profit (and counting) overnight.

Beware of trading bias – I was so attached to my long position that I failed to see an entry in the opposite direction. This is an important reminder to follow the signals and to take them when they show up (subject to correlation risk).

I'm still in my CHFJPY (T31S) and NZDCAD (T28S) shorts, both of which have made money already and are fully protected (stop loss at entry). As both of these trades have proved their worth, I'm looking to add to them if the signals show up.

As I'm technically on holiday, this will prove difficult today. I'm likely to miss the 10am and 2pm candle closes. This can't be helped and sometimes I know I'll miss signals because I can't be in front of my screen. This is part of the life of a forex trader and specifically the time frame I choose to trade.

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment