Month 2, Day 39 - 36-month forex trading challenge - winning doesn't matter!

I've always been amazed in life as to the power of curiosity. An interest in a particular topic or subject, leads to a book or article – in turn this book or article leads to something else, and so on, and so on. It can be a never-ending journey of exploration, and although the destination is never reached, the nuggets you pick up along the way are worth their weight in gold.

This is exactly what happened to me during the last 24 hours. The book I read on holiday, titled Trading Mentors, profiled a trader by the name of Rayner Teo. At some point since returning home, I must have visited his website to sign up for a free PDF download profiling the habits of great traders. Since then he's been emailing me on a regular basis with additional offers, the majority of which I've not read (my inbox tends to get very full).

Yesterday however was different and something in one particular email caught my eye and led me to a YouTube clip that Rayner had recorded for his channel. The video, which you can watch here, talked a lot of sense and reinforced principles I have firmly built into my trading approach. What caught my attention in particular was the trading books Rayner shared six minutes into the video. I'm always on the lookout for new books. To be clear I'm not in search of the next shiny trading strategy, far from it in fact, but I'm always curious how other traders approach the market (whatever that market is), and usually take at least one golden nugget away in value from my time invested in reading.

Of the three books profiled, Unholy Grails by Nick Radge caught my attention. I've never heard of Nick, but the reviews read well and his message being contrarian in nature looked interesting. Perhaps it was the title? After all, a book titled The Holy Grail Trading System served in part as inspiration for my very own (36-month) forex trading challenge.

Whatever the catalyst, I bought the book and began reading. So far, so good and the insight and understanding of trading that Nick brings are very much on point. In particular he provided a very important reminder of the three key ingredients of any successful trading strategy, along with three associated questions:

Nick is a momentum trader, choosing to buy high and sell higher, rather than buy cheap in the hope that prices will reverse and move higher. He uses a great analogy of a hitchhiker, who will only join a ride that is heading in the right direction.

Momentum is the approach on my GOLDEN GATE, TREND and FULL HOUSE strategies, with my RANGE strategy being the only one where I'm actively trading against the current direction of travel.

The book argues that most beginner traders focus too much on point 3 above. They want to win, and they want to win as often as possible. Society rewards winners, but the same can't always be said in trading. Those in search of the perfect system that wins all the time are on a futile quest, which will likely see them chop and change systems on a regular basis, not to mention blowing up multiple trading accounts.

What matters are points 1 and 2, which combined are essentially the reward-to-risk ratio. If on balance you win more when you win, and lose less when you lose, you can in fact develop a winning approach where you're wrong more than you're right. It's back to the advice advocated by all the trading greats – cut your losses short and let your profits run.

The obsession of the beginner trader is what constitutes the right entry signal. The author describes the factors for entry as 'comfort' items only. What really matters is your reward-to-risk ratio, which is of more importance than the number of times you actually win or lose.

I'm only 20% through the Kindle edition, but already the golden nuggets are piling up, to more than outweigh the purchase price. To link back to today's blog post title then – winning doesn't matter – it's how much you win when you win (compared with how much you lose when you lose) that does!

Reading has always been an important part of my trading approach. It helps to know that you're not alone (there are other traders out there) and serves to positively reinforce the most important things in trading any market – your mindset and trading psychology.

Anyway, I'd thought I's share this in today's blog post and will no doubt highlight other trading books I read moving forward. But now, let's get back to the charts and see where we are, particularly in light of last night's FOMC meeting minutes.

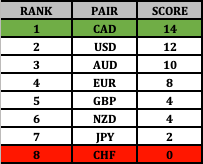

Well the FOMC came and went, and to be honest their message wasn't particularly clear (it usually isn't). In any case, it's not the message that matters, but instead the market reaction that counts. Overnight USD looks to have strengthened against the majority of its counterparts, and sits only second to CAD in my daily relative strength table.

Ahead of FOMC I entered a new position in AUDCHF (T5L). I mentioned I was watching this pair in yesterday's blog post, but chose to trade AUDJPY (T4L) in preference. Both of these pairs are carry trades, which means I'm less concerned about speed of movement to my target, as the carry (interest rate differential) is on my side. I've taken a tighter stop on AUDCHF (20 pips behind the 50 SMA), which gives me a target to take off 50% of my position inside the 200 SMA (my issue with this pair yesterday).

Although I've taken some heat overnight, I'm still confident in my bids in AUDJPY and AUDCHF. What's more, although IG in focus is showing me a sell signal on AUDJPY, as I discussed in day 36 & 37's blog post, my rules now allow me to take an entry if my carry, weekly relative strength and daily relative strength all point in the same direction. This is true for AUDJPY, as it is for AUDCHF.

Well that's it for today. I'm off to the doctors again this morning (twice in one week), as I'm still feeling under the weather. Feeling rough makes trading difficult, but not impossible and as always in life, determination to keep going is key.

It's still the school holidays, so we're travelling as a family today, which means a week of trading on the move, and some interesting locations for the STG FOREX TV YouTube channel.

I've just started reading a book on the life of Admiral Horatio Lord Nelson (a clue to where we're going). Containing over 900 pages, Nelson: A Dream of Glory is going to take me a while to get through, but I'm already hooked.

In a document penned by Nelson in 1799 (detailed on page 4 of the book), Britannia's naval hero states: 'That perseverance in any profession will most probably meet its reward.'

What great advice, then, now, and for years to come!

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

This is exactly what happened to me during the last 24 hours. The book I read on holiday, titled Trading Mentors, profiled a trader by the name of Rayner Teo. At some point since returning home, I must have visited his website to sign up for a free PDF download profiling the habits of great traders. Since then he's been emailing me on a regular basis with additional offers, the majority of which I've not read (my inbox tends to get very full).

Yesterday however was different and something in one particular email caught my eye and led me to a YouTube clip that Rayner had recorded for his channel. The video, which you can watch here, talked a lot of sense and reinforced principles I have firmly built into my trading approach. What caught my attention in particular was the trading books Rayner shared six minutes into the video. I'm always on the lookout for new books. To be clear I'm not in search of the next shiny trading strategy, far from it in fact, but I'm always curious how other traders approach the market (whatever that market is), and usually take at least one golden nugget away in value from my time invested in reading.

Of the three books profiled, Unholy Grails by Nick Radge caught my attention. I've never heard of Nick, but the reviews read well and his message being contrarian in nature looked interesting. Perhaps it was the title? After all, a book titled The Holy Grail Trading System served in part as inspiration for my very own (36-month) forex trading challenge.

Whatever the catalyst, I bought the book and began reading. So far, so good and the insight and understanding of trading that Nick brings are very much on point. In particular he provided a very important reminder of the three key ingredients of any successful trading strategy, along with three associated questions:

- How much do you win when you win?

- How much do you lose when you lose?

- How often do you win?

Nick is a momentum trader, choosing to buy high and sell higher, rather than buy cheap in the hope that prices will reverse and move higher. He uses a great analogy of a hitchhiker, who will only join a ride that is heading in the right direction.

Momentum is the approach on my GOLDEN GATE, TREND and FULL HOUSE strategies, with my RANGE strategy being the only one where I'm actively trading against the current direction of travel.

The book argues that most beginner traders focus too much on point 3 above. They want to win, and they want to win as often as possible. Society rewards winners, but the same can't always be said in trading. Those in search of the perfect system that wins all the time are on a futile quest, which will likely see them chop and change systems on a regular basis, not to mention blowing up multiple trading accounts.

What matters are points 1 and 2, which combined are essentially the reward-to-risk ratio. If on balance you win more when you win, and lose less when you lose, you can in fact develop a winning approach where you're wrong more than you're right. It's back to the advice advocated by all the trading greats – cut your losses short and let your profits run.

The obsession of the beginner trader is what constitutes the right entry signal. The author describes the factors for entry as 'comfort' items only. What really matters is your reward-to-risk ratio, which is of more importance than the number of times you actually win or lose.

I'm only 20% through the Kindle edition, but already the golden nuggets are piling up, to more than outweigh the purchase price. To link back to today's blog post title then – winning doesn't matter – it's how much you win when you win (compared with how much you lose when you lose) that does!

Reading has always been an important part of my trading approach. It helps to know that you're not alone (there are other traders out there) and serves to positively reinforce the most important things in trading any market – your mindset and trading psychology.

Anyway, I'd thought I's share this in today's blog post and will no doubt highlight other trading books I read moving forward. But now, let's get back to the charts and see where we are, particularly in light of last night's FOMC meeting minutes.

Well the FOMC came and went, and to be honest their message wasn't particularly clear (it usually isn't). In any case, it's not the message that matters, but instead the market reaction that counts. Overnight USD looks to have strengthened against the majority of its counterparts, and sits only second to CAD in my daily relative strength table.

Although I've taken some heat overnight, I'm still confident in my bids in AUDJPY and AUDCHF. What's more, although IG in focus is showing me a sell signal on AUDJPY, as I discussed in day 36 & 37's blog post, my rules now allow me to take an entry if my carry, weekly relative strength and daily relative strength all point in the same direction. This is true for AUDJPY, as it is for AUDCHF.

Well that's it for today. I'm off to the doctors again this morning (twice in one week), as I'm still feeling under the weather. Feeling rough makes trading difficult, but not impossible and as always in life, determination to keep going is key.

It's still the school holidays, so we're travelling as a family today, which means a week of trading on the move, and some interesting locations for the STG FOREX TV YouTube channel.

I've just started reading a book on the life of Admiral Horatio Lord Nelson (a clue to where we're going). Containing over 900 pages, Nelson: A Dream of Glory is going to take me a while to get through, but I'm already hooked.

In a document penned by Nelson in 1799 (detailed on page 4 of the book), Britannia's naval hero states: 'That perseverance in any profession will most probably meet its reward.'

What great advice, then, now, and for years to come!

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment