Month 2, Day 38 - 36-month forex trading challenge - the currency carry trade.

This morning, I'm still feeling rough again, but got up early to perform my morning market analysis and to make decisions for the day.

The six trades I was in yesterday are still in play, but moving much more slowly than I'd like. I'm wondering if this is down to it being August, where the big traders with the power to move the market are perhaps away on holiday at their beach villas or country retreats?

Whatever the reason it doesn't matter. I can't control the market, I can only control what I do, which is an important reminder of why trading psychology is the most important thing when it comes to successful trading.

For the past couple of days I've been watching AUDJPY and AUDCHF, which are pairs I like to trade long because of their carry trade credentials.

A carry trade involves benefiting from the different interest rates offered by central banks on their individual currencies. This is something I monitor on a daily basis, albeit rates tend to change on a lot less frequent basis and are usually major market moving events.

The carry trade is special because it carries an additional benefit for the forex trader. If I'm long on AUDJPY (see below), if price rises I stand to make a capital gain on the difference between my buy price and ultimate sell price. In addition, while in the trade I also stand to make a profit on the difference in interest rates, which will be paid to me by my broker. With any carry trade, the funding / quote currency (JPY) needs to have a lower interest rate than the base currency (AUD).

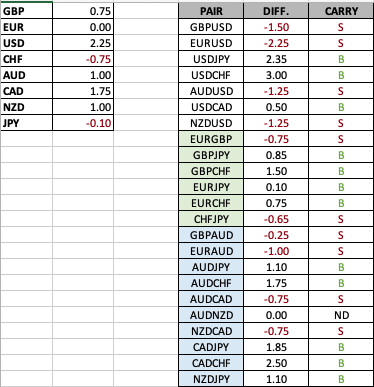

Below is my table recording current central bank interest rates for GBP, EUR, USD, CHF, AUD, CAD, NZD and JPY. On the left side I've recorded individual rates and then on the right, the relative difference between these rates, and whether the interest rate differential points to a carry trade buy, or a carry trade sell.

AUDJPY and AUDCHF both offer a positive carry trade interest rate differential when positioned to the buy side, and this when combined with the right technical signals (in line with my rules), can lead to some very interesting opportunities.

AUDJPY (240 chart) >

AUDCHF (240 chart) >

Although AUDCHF offers a higher interest rate differential, in my view AUDJPY is the better long option. AUDJPY is trading at and holding above its 10-year low, which in my mind always raises the question, who is left to sell? Although AUDCHF is showing a similar TREND bid opportunity it's at only a 3-year low and currently trading below it. In addition, with AUDCHF there is limited room to go, with the 200 SMA inside the 1:1 reward-to-risk level where I always take off 50% of any given trade. My 1:1 target for AUDJPY falls inside the 200 SMA.

On the face of it they are very similar trades, but this is where deeper analysis comes in, to identify the best opportunity. I already have long exposure to AUD with my EURAUD (T30S) short trade, and my correlation risk rules are strict in restricting me to only two unprotected positions in any given currency at any one time.

At 6am this morning I therefore entered a long position in AUDJPY (T4L), which so far is going my way. As always, only time will tell whether my assessment of market conditions is right, but remember this is only one trade in a portfolio of other trades I'm in.

When any of my trades begin to go against me, in line with specific signals detailed in my rules, I begin to lighten up, and as other trades move in my favour I pyramid in by adding more to these winners. This approach is designed to cut my losses short while at the same time, not just letting my winners run, but leveraging them to their full potential.

If you're reading this and have never factored the carry trade into your trading decisions, I'd encourage you to give it a closer look. Depending on your strategy it doesn't mean you should only ever trade in the direction of the carry trade. I will be a seller of AUDJPY for example if the right technical signals in line with my rules show up, but because of the additional benefit the carry trade offers, I'll always prefer to be a buyer.

Good trading is just as much about picking the right trades to be in, as it is staying out of the suboptimal ones. I also use the interest rate differential on different pairs I trade to select the best opportunity, if more than one potential opportunity presents itself.

One final point I should mention, is that my new trade in AUDJPY has taken me over my maximum risk exposure threshold. For the first three weeks of any month my rules stipulate that I can never exceed this level, but in the final week I am permitted to increase my risk providing it remains below 20% of my opening capital. The idea behind this is to spread my maximum risk exposure evenly over the month. In the final week, particularly if I am some way off target, I can choose to leverage up, which is a decision I've chosen to make today.

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

The six trades I was in yesterday are still in play, but moving much more slowly than I'd like. I'm wondering if this is down to it being August, where the big traders with the power to move the market are perhaps away on holiday at their beach villas or country retreats?

Whatever the reason it doesn't matter. I can't control the market, I can only control what I do, which is an important reminder of why trading psychology is the most important thing when it comes to successful trading.

For the past couple of days I've been watching AUDJPY and AUDCHF, which are pairs I like to trade long because of their carry trade credentials.

A carry trade involves benefiting from the different interest rates offered by central banks on their individual currencies. This is something I monitor on a daily basis, albeit rates tend to change on a lot less frequent basis and are usually major market moving events.

The carry trade is special because it carries an additional benefit for the forex trader. If I'm long on AUDJPY (see below), if price rises I stand to make a capital gain on the difference between my buy price and ultimate sell price. In addition, while in the trade I also stand to make a profit on the difference in interest rates, which will be paid to me by my broker. With any carry trade, the funding / quote currency (JPY) needs to have a lower interest rate than the base currency (AUD).

Below is my table recording current central bank interest rates for GBP, EUR, USD, CHF, AUD, CAD, NZD and JPY. On the left side I've recorded individual rates and then on the right, the relative difference between these rates, and whether the interest rate differential points to a carry trade buy, or a carry trade sell.

AUDJPY and AUDCHF both offer a positive carry trade interest rate differential when positioned to the buy side, and this when combined with the right technical signals (in line with my rules), can lead to some very interesting opportunities.

AUDJPY (240 chart) >

AUDCHF (240 chart) >

Although AUDCHF offers a higher interest rate differential, in my view AUDJPY is the better long option. AUDJPY is trading at and holding above its 10-year low, which in my mind always raises the question, who is left to sell? Although AUDCHF is showing a similar TREND bid opportunity it's at only a 3-year low and currently trading below it. In addition, with AUDCHF there is limited room to go, with the 200 SMA inside the 1:1 reward-to-risk level where I always take off 50% of any given trade. My 1:1 target for AUDJPY falls inside the 200 SMA.

On the face of it they are very similar trades, but this is where deeper analysis comes in, to identify the best opportunity. I already have long exposure to AUD with my EURAUD (T30S) short trade, and my correlation risk rules are strict in restricting me to only two unprotected positions in any given currency at any one time.

At 6am this morning I therefore entered a long position in AUDJPY (T4L), which so far is going my way. As always, only time will tell whether my assessment of market conditions is right, but remember this is only one trade in a portfolio of other trades I'm in.

When any of my trades begin to go against me, in line with specific signals detailed in my rules, I begin to lighten up, and as other trades move in my favour I pyramid in by adding more to these winners. This approach is designed to cut my losses short while at the same time, not just letting my winners run, but leveraging them to their full potential.

If you're reading this and have never factored the carry trade into your trading decisions, I'd encourage you to give it a closer look. Depending on your strategy it doesn't mean you should only ever trade in the direction of the carry trade. I will be a seller of AUDJPY for example if the right technical signals in line with my rules show up, but because of the additional benefit the carry trade offers, I'll always prefer to be a buyer.

Good trading is just as much about picking the right trades to be in, as it is staying out of the suboptimal ones. I also use the interest rate differential on different pairs I trade to select the best opportunity, if more than one potential opportunity presents itself.

One final point I should mention, is that my new trade in AUDJPY has taken me over my maximum risk exposure threshold. For the first three weeks of any month my rules stipulate that I can never exceed this level, but in the final week I am permitted to increase my risk providing it remains below 20% of my opening capital. The idea behind this is to spread my maximum risk exposure evenly over the month. In the final week, particularly if I am some way off target, I can choose to leverage up, which is a decision I've chosen to make today.

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment