Month 2, Day 43 - 36-month forex trading challenge - stalking the entry.

I've woken up to good news this morning. My NZDUSD (T32S) short has fallen overnight and is progressing (albeit slowly) in the direction I've put my money behind.

Waking up to see trades in profit always feels good and is a completely different experience to the opposite situation – when my trades are in the red!

Any trade I make is just one trade in a long line of trades I will make throughout the 36-month forex trading challenge, and it's important to remember this. My emotions waking up to winning positions are very different to those when faced with positions under pressure, and with emotions involved it can be tempting to make rash decisions that could hurt the overall performance of my system (hold losers for too long or cut profits short).

It's a reminder that my job is simply to follow my rules. This is why a trading system with strict criteria for entry, exit and trade management is so important. It helps to take the emotion out of any situation and remove the need for decision-making in the heat of battle. The decision to do something or not is preplanned.

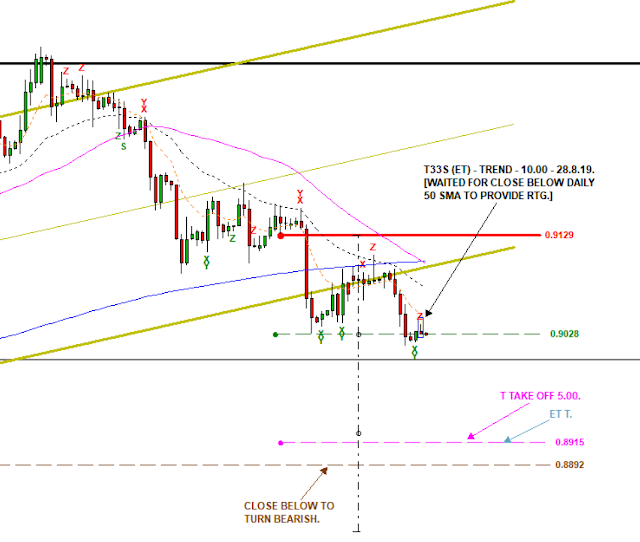

The title of today's blog post is 'stalking the entry', and this is exactly what I've done on EURGBP. This morning I entered a short position (T33S) that I've been waiting for since the SIG. LEVEL 1 high (black line below) was rejected on 12 August.

At 6am I got my TREND entry signal.

The 10 EMA cross below the 50 SMA occurred on the 19th, but with the 50 SMA sloping up I was unable to take the entry. Also a preceding higher high negated this as a valid entry signal to get short. The 30 EMA cross below the 50 SMA was a valid entry with the 50 SMA now flat and a lower low created on the 240 chart, but for whatever reason I missed it.

I've been waiting ever since, and my rules gave me another opportunity when price closed below the 200 SMA and below the bottom of the upward daily trend line. However at this point there was limited room for this trade to move, with the looming presence of the 50 SMA on the daily chart in the way.

The daily 50 SMA (see above) could very well have attracted bids and I waited for a close below on the daily chart before getting short this morning. Yes, I've got in later and at a worse price than if I had simply sold off the high, but sometimes the best price doesn't give the best signal or the highest probability of your trade working out as you'd planned. Paying a slightly worse price is sometimes the premium you're better off paying if it secures more clues in favour of your assertion of where the market is most likely to move next.

My short is now below the 50 and 200 SMAs on the 240 chart, and the daily 50 SMA, with room to secure a 1:1 reward-to-risk ratio before hitting the daily 200 SMA. This is a high-probability trade in line with my rules that I've taken.

Stalking a trade entry requires patience, but is a much better approach to buying or selling on a whim in the heat of the moment.

In addition, this morning I've added to my NZDCAD (T28S) short.

A YX candle presented itself on the 6am close, and was my opportunity to add a second position. I always pyramid into trades on strength and that's exactly what this pair showed me today. I got in slightly after the candle close, as I was busy setting up my EURGBP short at the time, but with room to progress the additional cost I felt was worth the expense.

As always, only time will tell, and I know (bringing me full circle to the beginning of this blog post) that it is only one of many trades I will make on this three-year journey.

Today the weather is not great here on the Isle of Wight. With heavy rain overnight, it's likely we won't be adventuring too far today. This means I should catch the 10am and 2pm candle closes.

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Waking up to see trades in profit always feels good and is a completely different experience to the opposite situation – when my trades are in the red!

Any trade I make is just one trade in a long line of trades I will make throughout the 36-month forex trading challenge, and it's important to remember this. My emotions waking up to winning positions are very different to those when faced with positions under pressure, and with emotions involved it can be tempting to make rash decisions that could hurt the overall performance of my system (hold losers for too long or cut profits short).

It's a reminder that my job is simply to follow my rules. This is why a trading system with strict criteria for entry, exit and trade management is so important. It helps to take the emotion out of any situation and remove the need for decision-making in the heat of battle. The decision to do something or not is preplanned.

The title of today's blog post is 'stalking the entry', and this is exactly what I've done on EURGBP. This morning I entered a short position (T33S) that I've been waiting for since the SIG. LEVEL 1 high (black line below) was rejected on 12 August.

At 6am I got my TREND entry signal.

The 10 EMA cross below the 50 SMA occurred on the 19th, but with the 50 SMA sloping up I was unable to take the entry. Also a preceding higher high negated this as a valid entry signal to get short. The 30 EMA cross below the 50 SMA was a valid entry with the 50 SMA now flat and a lower low created on the 240 chart, but for whatever reason I missed it.

I've been waiting ever since, and my rules gave me another opportunity when price closed below the 200 SMA and below the bottom of the upward daily trend line. However at this point there was limited room for this trade to move, with the looming presence of the 50 SMA on the daily chart in the way.

The daily 50 SMA (see above) could very well have attracted bids and I waited for a close below on the daily chart before getting short this morning. Yes, I've got in later and at a worse price than if I had simply sold off the high, but sometimes the best price doesn't give the best signal or the highest probability of your trade working out as you'd planned. Paying a slightly worse price is sometimes the premium you're better off paying if it secures more clues in favour of your assertion of where the market is most likely to move next.

My short is now below the 50 and 200 SMAs on the 240 chart, and the daily 50 SMA, with room to secure a 1:1 reward-to-risk ratio before hitting the daily 200 SMA. This is a high-probability trade in line with my rules that I've taken.

Stalking a trade entry requires patience, but is a much better approach to buying or selling on a whim in the heat of the moment.

In addition, this morning I've added to my NZDCAD (T28S) short.

A YX candle presented itself on the 6am close, and was my opportunity to add a second position. I always pyramid into trades on strength and that's exactly what this pair showed me today. I got in slightly after the candle close, as I was busy setting up my EURGBP short at the time, but with room to progress the additional cost I felt was worth the expense.

As always, only time will tell, and I know (bringing me full circle to the beginning of this blog post) that it is only one of many trades I will make on this three-year journey.

Today the weather is not great here on the Isle of Wight. With heavy rain overnight, it's likely we won't be adventuring too far today. This means I should catch the 10am and 2pm candle closes.

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment