Month 1, Day 16 - 36-month forex trading challenge - know your numbers and USDJPY short.

This morning I'm feeling a little agitated, or perhaps just impatient – to be honest I'm not sure.

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

It's day 16 of the 36-month forex challenge and I'd planned to be in a better position than I currently am by this stage of the first month. As things stand at the moment I'm 1.1% down on opening capital. This excludes profit on open positions, which until closed I can't count.

In the normal world, working consistently every day for no reward (or worse) would make no sense at all, but in trading it's about continuing to play the game until the big wins show themselves.

Although I'm a qualified accountant, I'm by my own admission not the best at maths (one of the reasons I left the accountancy profession back in 2000). To be a successful trader you don't need to be a mathematical genius, but you do need to know your numbers.

At the end of each week, I review my booked profit or loss for the month so far in relation to opening capital. I also focus heavily on my overall risk exposure, which must never exceed 1/3 of my maximum permitted drawdown for the month (this is set at 20% of opening capital).

As I write this, my current exposure (potential loss if I'm stopped out on all open trades) is £3,007.17, against my permitted exposure of £3,333,33 (£50K x 20% x 1/3).

I have six trades in play in GBPUSD (T13S), USDCHF (T12S), USDCAD (T9S), EURCHF (T11S), GBPAUD (T10S) and a new trade opened this morning in USDJPY (T14S), which I discuss in more detail below.

As a quick review, my trades in EURCHF and GBPAUD are both fully protected.

EURCHF – T has been hit and my stop is now at entry. If a signal shows up in line with my rules, I'll look to add to this position.

GBPAUD – T has been hit and I've added to this position. My stop is set, so that if price reverses and I'm stopped out, my profit on position 1 will pay for the loss on position 2 (I'll be at break-even or better).

In GBPUSD, USDCHF and USDCAD I've lightened up on each trade to the tune of 1/3. Therefore risk on each position is now at 1.3%, instead of 2%.

I'm therefore short two positions on USD (T9S & T12S) and long USD in one position (T13S). This means my overall exposure to USD is 2 x 1.3% less 1 x 1.3% = 1.3%.

Therefore, this morning at 6am when a short signal showed up in USDJPY I took it. Risking 2% on this trade, my overall exposure to USD is now 3.3%. My correlation risk rules restrict me from having in excess of 4% exposure to any one currency, so by placing this additional USD trade I'm well within limits.

The other number I'm acutely aware of is trade funds available (TFA), which is calculated automatically in my ETX Capital broker account. TFA is per account, so currently sitting at just over £1,200 is currently 4.8% of the opening balance on this account (£25K). TFA is constantly moving – it rises as my open trades grow in profit and falls if things begin to go against me. If TFA falls into negative territory I run the risk of a margin call from my broker, where they'll ask me to top up funds in my account or run the risk of them potentially closing out my positions for me.

The rules are strict on this challenge and there is no provision to top up my account balance. TFA is therefore a number I need to keep a close eye on. It encourages me to close out opening positions that could be stalling in order to free up capital to take better positions that could show up.

With all of my trades this morning hovering at entry or better I'm on the right side of the margin requirements. Things though can change at a moment's notice in the currency markets – I always need to be vigilant and ready to act.

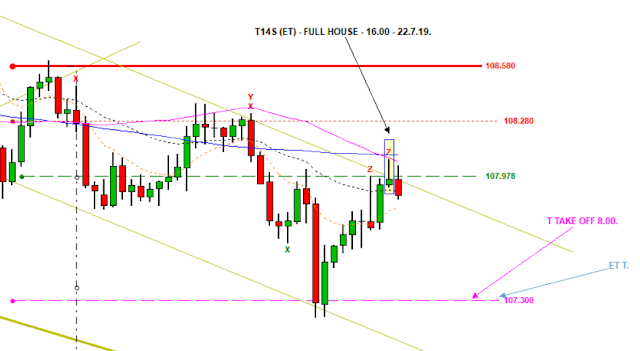

Ok, so back to that USDPY (T14S) trade I opened on the 6am close:

A FULL HOUSE signal, showed up on the rejection of the 50 SMA. This occurred at the top of the trend line on the 240 chart where price was preceded by a lower low. A test of this low will see me take off 50% of my position for a profit (T), in line with my rules. If this happens my stop will then me moved to entry (107.98).

Only time will tell, and with this trade moving in my favour almost immediately, I'm taking this as a good sign.

So with all my analysis done for the day, my job now is to review my positions on the candle close every four hours.

Is it still possible to hit my target of a 10% return on opening capital this month? Well yes, I believe it is!

Finally, a quick update on the two rogue GBPAUD trades in eToro. I've now had a message back from customer service who had this to say:

Thank you for bearing with us as we investigated your claim with the technical department.

Finally, a quick update on the two rogue GBPAUD trades in eToro. I've now had a message back from customer service who had this to say:

Thank you for bearing with us as we investigated your claim with the technical department.

We ran a thorough check of our logs, and noted two clear and separate requests to open each of the GBPAUD buy positions, IDs 473658405 and 473658389, from an iOS device.

In addition to the above, we did not detect any suspicious logins in the account, and confirm that there has been no breach in the security of our platform.

What actually happened will forever remain a mystery. The only rational explanation is while shopping in London and periodically checking my positions, I inadvertently set the two buy positions in error. Possibly a fat-finger error and a valuable lesson learnt – to be very careful checking positions on my phone moving forward.

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment