Month 1, Day 13 - 36-month forex trading challenge - trading books and trade updates.

Day 13 of the 36-month forex trading challenge and I have a couple of thoughts swimming around my head this morning:

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

- I feel much better when I follow my rules. This morning I woke up to a signal on my USDCAD (T9S) short to lighten up on 1/3 of my position. I hesitated for a bit while I did my daily market analysis, but had a nagging feeling in my stomach that just wouldn't go away. I just pulled the trigger to exit 1/3, and now feel much better. Perhaps this is a positive change in my discipline and thinking. The discomfort of not following my rules is now greater than the pain of admitting that I might have got things wrong.

- I'm pretty bored. The daily routine of analysing each currency pair is somewhat tedious. In a regular business (or job) the feeling of boredom would likely be a bad sign and a clue to go and do something different, but in trading boredom is a really good clue that I'm on the right track. Those who trade for entertainment or excitement lose money. Good trading is boring!

Yesterday was all about USD strength (thanks to the Federal Reserve). This caused some heat in my trades in USDCAD and USDCHF (T11S). Although I've lightened up on the former, both pairs are still valid trades that I'm sticking with. I'm sticking with them not out of stubbornness, but because from a technical perspective and in line with my rules, they still make good sense.

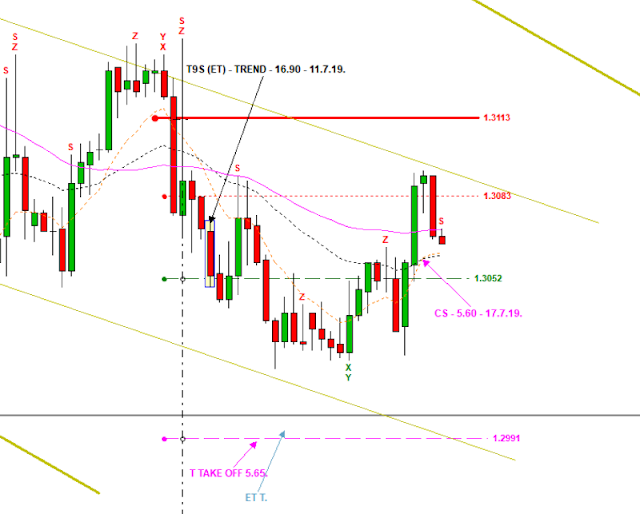

Here's a quick visual summary of where we are:

USDCAD (T9S) >

Note where I've exited 1/3 and that price has now closed back below the 50 SMA in the direction of my trade. As I was asleep I exited 1/3 of my position at a more favourable price than if I'd exited at 2am. I can't be awake 24-hours a day and rely on my stop loss to work for me while I'm asleep.

USDCHF (T12S) >

The 200 and 50 SMA held overnight, but I may need to lighten up on 1/3 of my position if the 10am candle close sees the 10 EMA (Exponential Moving Average) cross above the 30 EMA. If this happens (see point 1 above), I'll exit without emotion and know it will make me feel better.

Now a quick update on my other two open trades:

EURCHF (T11S) >

So far, so good on this trade, which is working perfectly, albeit a little bit slower than I'd like. Still patience is a virtue and this is where the boredom comes in. I need to sit on my hands, as there's nothing to do right now.

GBPAUD (T10S) >

Without doubt, this is the outstanding trade of the month so far. I have profit locked in having hit my initial target (T), and added to the position yesterday. This is the type of trade I'm always looking for, and the one that could make my month.

As I've mentioned before – in trading you win, you lose, you win, you lose and then you catch a move and win big. Losses should always be capped by your stop loss and exit rules, but winners have unlimited potential. Good trading is about risk management to the downside and capitalising on the upside to it's full potential.

My job now is to hold, hold and hold some more, until my rules tell me different.

To battle the boredom of trading I read a lot. As I mentioned in Monday's blog post, I'm reading the Formula For Success by Samuel Leach. It's a really good read and he talks a lot about beliefs and reinforcing empowering beliefs by surrounding yourself with the right people. A fight fan like me, he makes some useful comparisons to the world of boxing, where the best fighters learn from those who have gone before. Mike Tyson was not only an outstanding fighter, but also a student of past champions. This knowledge he absorbed and assimilated into his own style, and what a style it was.

In Pit Bull (mentioned in previous blog posts), Marty Schwartz describes himself as a 'synthesiser' – learning from others and through a process of trial and error he synthesised his own unique approach to the markets.

My approach is also in part a synthesis of past masters gleaned in part from a number of books (in addition to Pit Bull) that I'd highly recommend. These include:

Time Compression Trading: Exploiting Multiple Time Frames in Zero Sum Markets by Jason (Alan) Jankovsky. Unfortunately, this book is not currently available on Amazon. I'm grateful to have mine and also for the time I spent learning directly from Jason.

Think & Trade Like a Champion: The Secrets, Rules & Blunt Truths of a Stock Market Wizard by Mark Minervini.

Stan Weinstein's Secrets for Profiting in Bull and Bear Markets by Stan Weinstein.

How I Made $2,000,000 in the Stock Market by Nicolas Darvas.

All are excellent reads, and what's interesting is that none are about currency trading. The markets are the markets whatever you choose to trade. It's the principles in these texts that are extremely valuable.

Ok, that's all for today, apart from to say that the video charting (to coin a phrase) week 2 of the 36-month forex trading challenge is now available to view on YouTube here. It was a difficult week, but also an enjoyable one, find out why here.

*********

Is it really possible to turn £50K into £1M? Over the next 36 months I'm going to find out by trading my personal account with full transparency.

Follow my 36-month challenge to turn £50K into £1M.

Read my blog here: https://stgforextvforexchallenge.blogspot.com

Subscribe on YouTube here: https://www.youtube.com/channel/UCyGySJ5IeDjq-DIJPU7nYvw

[Please note, the information presented is general educational material and does not constitute trading advice.

Trading foreign exchange (forex) on margin carries a high level of risk and may not be suitable for you or your circumstances.

Before trading forex you should investigate all of the risks, including the possibility that you could lose more than your initial investment.

It’s important to consider your investment objectives, level of experience and risk appetite. If in doubt seek advice from an independent financial advisor.]

Comments

Post a Comment